There is no greater feeling than finally going on vacation. However, you must be careful on how you exchange your funds to local currency. There’s a large risk of losing value to your dollar if you don’t know the basics of currency exchange.

I’ve put together a list of dos and don’ts to ensure you get the best value for your dollar when traveling abroad.

Do use your credit card.

A credit card with no foreign transaction fees is the best way to get the most out of your money because you will be charged the exact foreign exchange rate for your purchases.

If you don’t have any established credit, I suggest you apply for the Capital One Platinum MasterCard. This was my first credit card. By only putting down a $40 deposit with a zero dollar annual fee, they accepted me without any credit. Do not waste your time applying to other cards; they will not take you and you’ll hurt your pre-existing credit. Plus, Capital One does not require you to give them a call before traveling abroad. This avoids any misunderstandings and the possibility of getting your card blocked.

The last thing to know about traveling with a credit card is that it is okay to max out your card. In fact, it will actually raise your credit score if you pay it in full before the due date. When I maxed out my credit card while traveling abroad, I was actually able to raise my credit score by 70 points. So, don’t be afraid, but make sure you stay on top of your payments and due dates.

Do bring your debit card.

Many well-known banks charge hefty fees for using your debit card internationally, but you still need it in case of an emergency. You do not want to be left stranded without any access to cash. Always bring your debit card.

Do bring cash.

You never know when someone will not accept a card. So make sure you have some cash in the local currency.

However, don’t bring too much cash.

If something happens such as getting robbed or you lose your money, you don’t want to end up in a crisis.

Don’t exchange your cash at your destination.

You are probably traveling to a touristy location which means currency exchange shops are going to be ridiculously expensive. You will lose a lot of money exchanging your cash at your destination and you are better off withdrawing from an ATM.

Do always exchange your money before you travel.

This does not include the airport. I exchange my cash at Currency Exchange International located in the Ontario Mills Mall. They tend to have competitive rates. I also hear there are some good spots in Downtown Los Angeles. So do some research and make sure to get that cash beforehand.

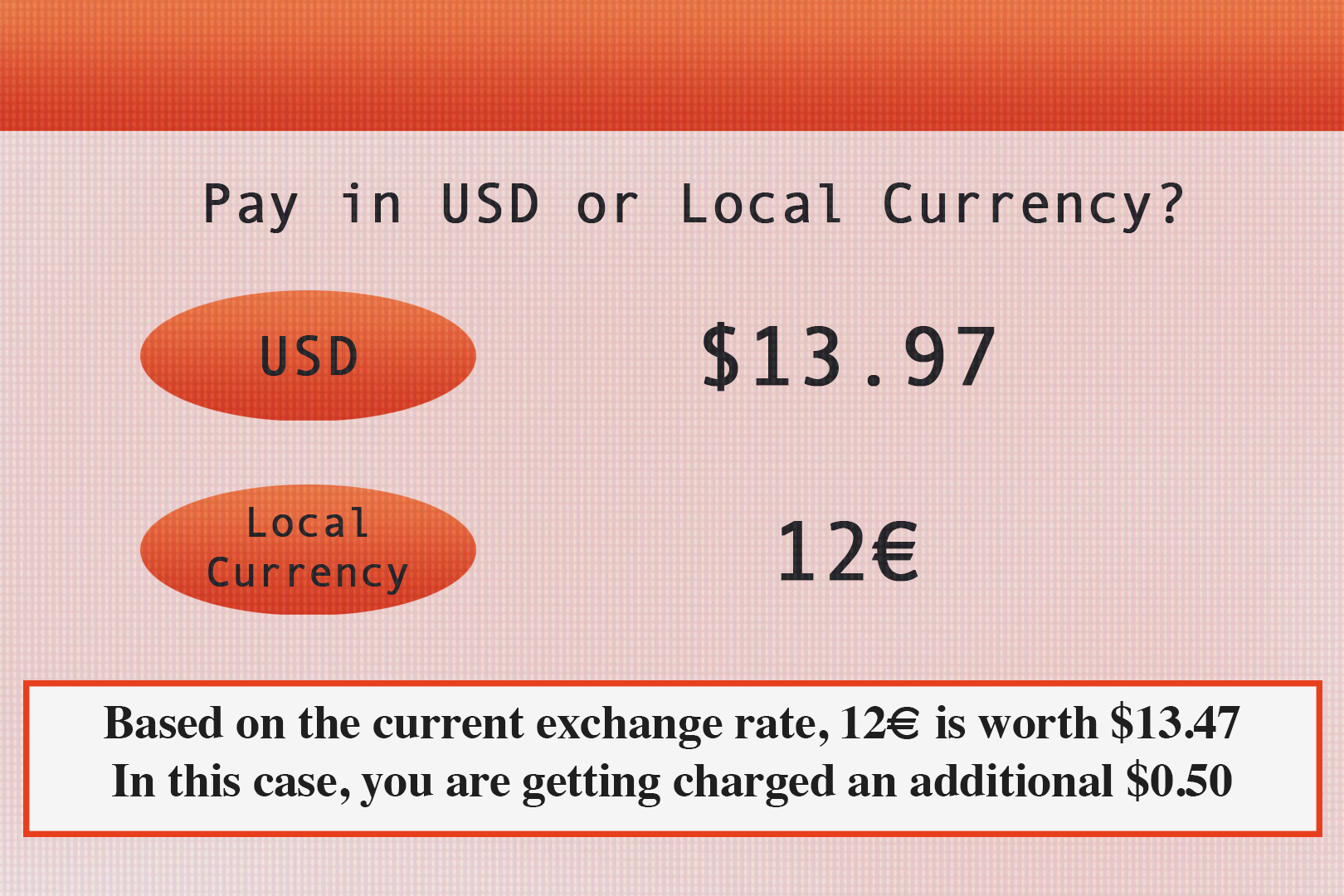

Don’t pay in USD versus local currency.

Sometimes when you pay with a card in another country, it will ask you if you would like to pay in USD or local currency. If you are paying with your credit card that has no foreign transaction fees, always pick local currency. When you select USD, it will charge you at their exchange rate which is higher than the actual exchange rate and therefore you will be losing out on your money. I cannot stress this enough, always select local currency.

There are a lot of pitfalls in exchanging your currency, but hopefully these tips can help you avoid losing your money.