On Tuesday, May 29, Mt. SAC President William Scroggins and Joan Sholars, Vice President of the Faculty Association and Professor of Mathematics, co-hosted a forum for faculty to discuss the potential change in third party health care provider from CalPERS to SISC.

CalPERS stands for the California Public Employees’ Retirement System and SISC stands for Self-Insured Schools of California, both are third party providers.

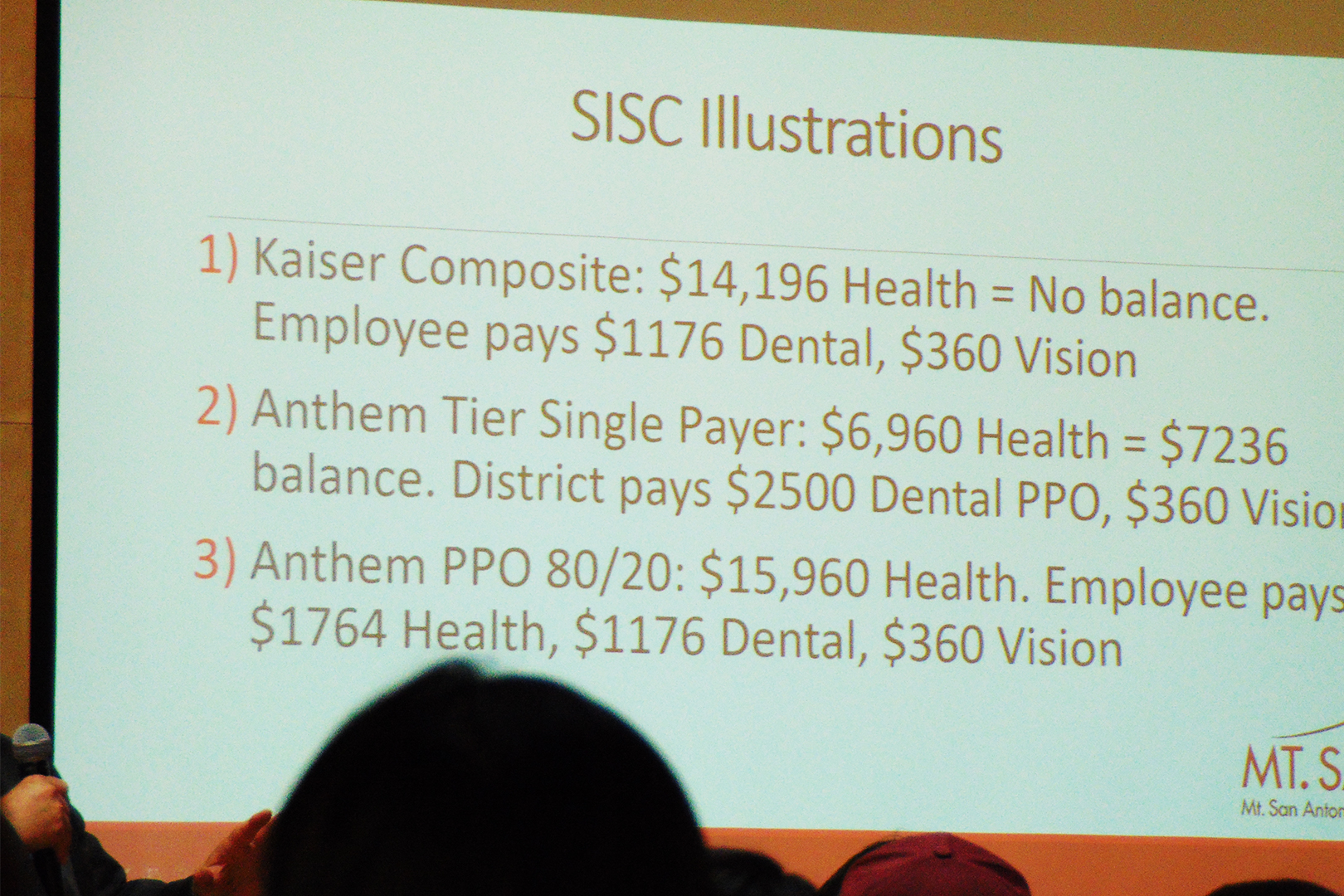

In the information session, three options were provided alongside explanations of what they meant.

An important distinction was repeated throughout the meeting regarding these options and their details, “everything is negotiable” and “nothing is set in stone” by both Sholars and Scroggins.

Scroggins said he cannot give the exact number “because we don’t have the check yet.” Later in the meeting Scroggins added, “I don’t think Mt. SAC will go bankrupt.”

The first option involves a transfer to SISC and an annual $14,196 district contribution for a Kaiser Composite plan.

The transfer to SISC instead of other potential third party health care providers comes about for three main reasons. CalPERS’ no compete clause, Scroggin’s prior experience with the provider, and a lower price all made SISC an option.

In respect to the clause, other providers could not be contacted. CalPERS also does not provide a claims history which further complicated things.

In regards to familiarity with the provider’s management, Scroggins himself was covered under SISC when he worked at the College of the Sequoias.

Price wise, the presentation included a slide with years from 2012 to 2018, showing CalPERS and SISC percentages.

In option one, if district pays in excess of the plan, excess goes to vision/dental, but this plan is also no opt out and does not include cash-back payments. District cost is estimated at $6 million, a combination of growth and COLA.

COLA stands for Cost-Of-Living Adjustment and is provided by the district.

The second option is the bargaining unit stays with CalPERS and the benefit package remains the same, with opt out and cash back. It also offers a 2.71 percent COLA on all compensation. This option still makes a future transfer to SISC possible.

The third option is to transfer to SISC as a third party provider only. This results in an equal or better benefit package with opt out and cash back. The district will pay for a “true up” fund and provide the 2.71 percent COLA.

There was also discussion regarding cash back or cash in lieu, with Scroggins saying they are consulting attorneys as the ability to pay cash in such a way is only mentioned in guidelines.

If district can go through with cash in lieu, it will be done through Mt. SAC and not SISC.

“We’re just not sure,” Sholars said. Even as a lead negotiator for faculty, there is still information that is unknown to the negotiators.

The negotiators are asking for information, but the decision must be made by the Wednesday, Aug. 8 Board of Trustees meeting.

For the purposes of this forum, however, all information requested was addressed.

After they explained the differences between the options and the effects on retirees, the two fielded questions from the audience to clarify the presentation.

With a full audience and more people than chairs there were several questions. After the audience questions were addressed by either Sholars or Scroggins himself, Sholars asked her own questions to Scroggins.

The PowerPoint from the meeting was to be emailed out, but there was hesitation in doing such, out of the fear that people would misunderstand that these are not the terms, but rather terms that can be negotiated.

This information session reaffirmed that nothing is done until the negotiating team talks about it, and that everything provided is up for negotiation.

The next forum on this issue is Friday, June 1 from 6-7 p.m. in building 46.