The Senate Republicans’ tax plan will hit people harder than the GOP claims according to the Congressional Budget Office, CBO. The new analysis released by the nonpartisan CBO predicts that the bill will increase taxes for the lower and middle class, cause 13 million people to lose health insurance, give a tax cut to the upper class and increase the national debt by $1.4 trillion. You can thank Republicans’ plan to repeal Obamacare’s individual mandate, which makes everyone buy medical insurance in order to lower premiums, for raising taxes and taking away health insurance. Here’s a breakdown of how the GOP tax plan will affect you.

Raising Taxes Year-by-Year

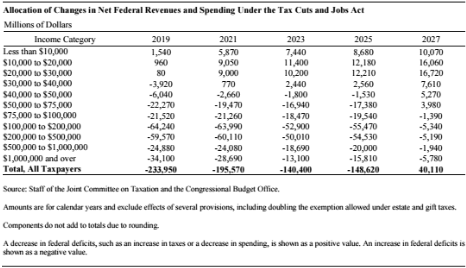

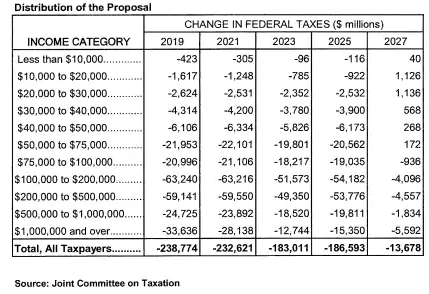

The simple fact is that starting in 2019 the GOP’s Tax Plan will raise taxes for everyone earning under $30,000. In 2021 Americans making $40,000 or less will see their taxes raised and by 2027, taxes would be raised for everyone making $75,000 or less.

While Americans making $100,000-$500,000, upper-middle class to upper class, and millionaires would see their taxes go down the most under the GOP tax plan.

To compare, Business Insider found the middle-class household in California makes between $40,127-$120,380. The highest upper boundary for a state’s middle class is at $144,966–meaning that the majority of tax cuts will go to the upper class.

Repealing Obamacare Individual Mandate

Another hit to the poor will be through the repeal of the Obamacare individual mandate. The individual mandate requires everyone to purchase health insurance in order to lower expenses all around. In short, having young and healthy people pay for health insurance who won’t use it as much as the sick and elderly will, lower the costs for the latter. The individual mandate is the foundation of Obamacare, which will likely fail without it.

If you’re starting to catch on, the repeal of the individual mandate means that healthcare premiums will rise for those most in need of it. The rise in premiums in 2019 will lead to the loss of health insurance for 4 million. By 2027, that number will jump to 13 million people losing their health insurance. This will lead to their taxes being raised even higher as they would no longer receive healthcare-related tax credits form the government.

Most of the higher taxes come from the repeal of the individual mandate as the Joint Committee on Taxation, which includes members of the Senate Finance Committee and the House Ways and Means Committee, found that without the immediate repeal of the individual mandate, every level of income would see lower taxes until 2027.

What happens in 2027? Under the Senate tax bill, if the individual mandate is not immediately repealed, it will expire in 2026. This will see everyone’s taxes increase from the year before and anyone making under $75,000 would see their taxes go up from what they are currently.

The GOP’s Tax Plan has already passed the Senate Finance Committee and is expected to be voted on by the Senate this week.